Why do liquor establishments need my tabc liquor tax consulting services?

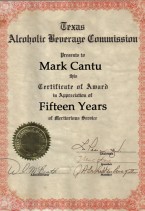

“Mixed Beverage TABC Liquor Tax Audits” are based on your purchases and not just your reported sales. The State estimates your sales using a program called “The Alcoholic Beverage Depletion Analysis” which converts your liquor, wine and beer purchases to estimated sales. They will then subtract your reported sales from the estimated sales to calculate an error rate which will be applied to all reported sales in the audit period. It is almost impossible to account for all purchases of liquor, wine and beer. Needless to say over 50% of taxpayers mixed beverage audits result in a tax due audit of tens and even hundreds of thousands of dollars in additional tax, penalty and interest. This is where my services come in. I will evaluate and test your business to make sure you are in compliance with all state record keeping requirements and insure your tax audit comes out the best possible. No one can match my over 40 years of experience with this tax, my 15 years as a TABC tax auditor, and, 13 years as a Comptroller liquor tax auditor, my 2000 plus audits conducted as an ex liquor tax auditor, and the results I’ve obtained, for clients, as listed on my website reference page. I am the best, bar none, and, will give you the best results.

LIQUOR TAX AUDIT ALERT!

As the holder of a License to sell alcoholic beverages in the state of Texas it is inevitable you will become the subject of a “Liquor Tax Audit!” Approximately half of all Liquor Tax Audits result in tax due.

Featured Testimonial:

Great Job Mark. We will absolutely use you on future audits. I really value your enthusiastic effort. Feel free to use me as a reference. It is crazy for any medium to high volume mixed beverage permitee to go through an audit without hiring you. – John Burke, Owner/CEO, Chacho’s (Reduced Client’s Audit from $300,000 to $0).

DON’T BE CAUGHT UNPREPARED!!

Audits can result in thousand of dollars in additional interest, penalties and taxes. You need the best Liquor Tax Consultant to protect your rights. Texas Liquor Control is owned and managed by Mark Cantu, the most experienced TABC Consultant in the state, bar none.

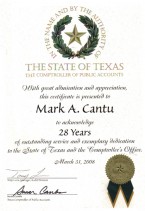

- Mark Cantu, Consultant, was an Auditor for the “TABC” and the “State Comptroller’s Office” for over 28 years.

- Mark Cantu has conducted over 2000 TABC liquor tax audits in his career.

- Mark Cantu has developed strong relations with

employees and key decision makers at both the

“TABC” and the “State Comptroller’s Office.”

UNMATCHED KNOWLEDGE AND EXPERIENCE!!!

As the holder of a License to sell alcoholic beverages in the state of Texas it is inevitable you will become the subject of a “Liquor Tax Audit!” Approximately half of all Liquor Tax Audits result in tax due.

- While others may claim to be experts at Liquor Tax Audits they simply cannot match Mark Cantu’s Experience, knowledge and background, along with a who’s who list of Texans who will vouch for his integrity and credibility.

- You can rest assured that with Mark Cantu you will receive the best liquor tax expert in the industry. His representation will insure you are prepared and in compliance with the law.

Helpful Links

Comptroller of Public Accounts

Texas Alcoholic Beverage Commission

Gerald Franklin TABC Licensing Agency

Clyde Burleson, TABC/DWI Attorney – 713/628-1503